Market & Fit Brief: GLP‑1

A customer walks into your store. She's lost 60 pounds on Wegovy. She's dropped from a 6X to an 3XL. And she needs a more supportive bra than she did at her highest weight.

This isn't intuitive. But it is rapidly becoming one of the most important fit challenges in the U.S. intimates market—and most retailers aren't ready for it.

The Market is Growing—Fast

The U.S. lingerie market is projected to grow from $17–23 billion in 2024 to $31–35 billion by 2033—a robust 6–8% annual growth rate. Within that expansion, plus-size intimates are one of the fastest-growing segments, representing both volume opportunity and high customer lifetime value.

The broader U.S. plus-size women's apparel market is forecast to reach ~$152 billion by 2033, growing at a 3.9% CAGR, with lingerie/innerwear emerging as a high-value growth engine—growing at 7.2% annually, significantly outpacing casualwear and dresses.

The GLP-1 Paradox: Smaller Sizes, Greater Support Needs

Approximately 10–12 million Americans are now using GLP-1 medications (semaglutide, tirzepatide) for weight loss and diabetes management. These drugs produce rapid, significant weight loss—typically 15–22% of body weight.

But Here's the Critical Shift:

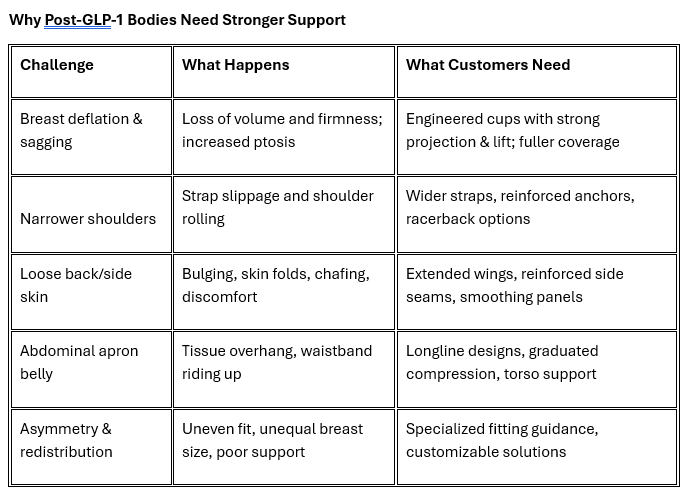

60–70% of GLP-1 users experience skin laxity (loose or excess skin) in the breasts, abdomen, arms, and thighs. A woman may drop from 3X to XL in dresses but actually need MORE engineered support in her bra, not less

The Business Case for U.S. Retailers

✅ High-Value Customer Segment

Plus-size bra customers show higher lifetime purchase value, stronger brand loyalty, and significantly lower return rates when fit is excellent—a key operational metric.

✅ Structural, Not Temporary

GLP-1 use is not a trend; it's a permanent shift in how millions of Americans manage weight. Retailers that serve post-weight-loss bodies well will capture these customers at a pivotal life moment and earn years of loyalty.

✅ Strong Margins

Plus-size intimates command premium price points and margins, especially when paired with expert fit guidance and education.

What Strategic Retailers Are Doing Now

1. Stock Engineered Solutions

Partner with plus-specialist brands offering deep cup ranges (D through O+), extended bands (34–54), and thoughtful grading systems that account for plus-figure anatomy.

2. Train Teams on Post-Weight-Loss Fit

Teach staff to recognize and troubleshoot strap slippage, band rolling, side bulges, breast asymmetry, and skin laxity.

3. Leverage Fit Education Tools

Use product finders, measurement guides, fit articles, and training content to help customers navigate their changing bodies.

4. Make Fit a Service, Not a Transaction

Offer personalized measurement, real-time troubleshooting, and style consultation—especially for customers navigating rapid body changes.

How Elila Helps U.S. Retailers

Elila specializes exclusively in plus-size and full-busted women and provides U.S. retailers with a comprehensive toolkit:

Engineered Sizing & Grading

Bands: 36–54 | Cups: A–O

Grading logic based on 30+ years of plus-figure anatomy

Intuitive scaling allows customers to move confidently through size ranges during weight-loss journeys

Fit Tools & Education Library

"Art of Bra Fitting" resources cover:

Strap slippage and shoulder fit troubleshooting

Breast asymmetry and uneven breasts

Why bras are expensive (reframing price to value)

Engineered fabrics and synthetic blends for superior support

Wirefree support options for comfort and security

Post-weight-loss fit challenges and solutions

Access at: elilausa.com/artofbrafitting

Body-Based Product Finder

Maps real-world fit complaints directly to specific bra architectures:

"My straps slip" → Wirefree or racerback styles with wider straps

"Nothing holds up my bust" → Full-cup, high-center-gore, underwired styles

"I have loose skin on my back/sides" → Extended wings, reinforced side seams

Comprehensive Product Range: 35+ Styles

All in consistent sizing, allowing retailers to solve multiple post-GLP-1 fit needs with one brand:

→ Style 1305: Jacquard Softcup

Firm support, full coverage, everyday wear. Jacquard 3-piece cup, full cup sling, wide back, 2-ply high-power support for pendulous and full busts.

🔗 https://www.elilausa.com/jacquard-softcup

→ Style 1303: Lace Softcup

Firm-support lace with full coverage and shaped band. Perfect for deflated but voluminous tissue that needs strong lift and separation—without a wire.

🔗 https://www.elilausa.com/lace-softcup

→ Style 1903: Molded Lace Softcup

Smooth, gentle molded cups with lace, ideal when tissue is softer post-weight-loss and needs round shaping, cushioning, and a natural profile.

🔗 https://www.elilausa.com/molded-lace-softcup-

→ Style 2311: Stretch Lace Full Coverage Underwire

Full-coverage stretch lace with lined cups, internal sling, and supportive bottom band. Built to lift, separate, and balance heavier or redistributed tissue.

🔗 https://www.elilausa.com/stretch-lace-full-coverage-underwire-1

The Bottom Line

The convergence of robust market growth, a large and growing plus-size customer base, and widespread GLP-1 adoption creates a rare strategic window for U.S. retailers.

Those who invest now in engineered, extended-size ranges, staff training, strategic partnerships with plus-specialist brands like Elila, and fit education tools will capture a high-value, loyal customer segment and grow profitable intimates revenue through 2033 and beyond.

Elila Resources & Retailer Support:

www.elilausa.com

elilausa.com/artofbrafitting

elilausa.com/measuring

Connect with Ellen Jacobson on LinkedIn:

https://www.linkedin.com/in/ellen-jacobson-8569311/